The Index strategy is based on qualitative and quantitative inputs including economic data and interpretations of government policy. Asset allocation guardrails include 50% – 200% allocation relative to the benchmark for credit, duration, and structure/mortgage weight. A high-conviction exposure to more speculative or diversifying positions is constrained to 0% – 20%.

The characteristics below reflect how we would best position a portfolio of fixed-income ETFs to achieve maximum total return over a comparable baseline neutral portfolio of fixed-income securities (benchmark).

Relative Positioning

Duration

Underweight

Yield Curve

Neutral

Corporate Credit

Underweight

Securitized

Neutral MBS

Conviction

5% USD Bullish & 5% 0-5 TIPS

Rationale

90% Underweight Duration

In April, the Index moved from an underweight duration position to neutral (100% of our benchmark duration).

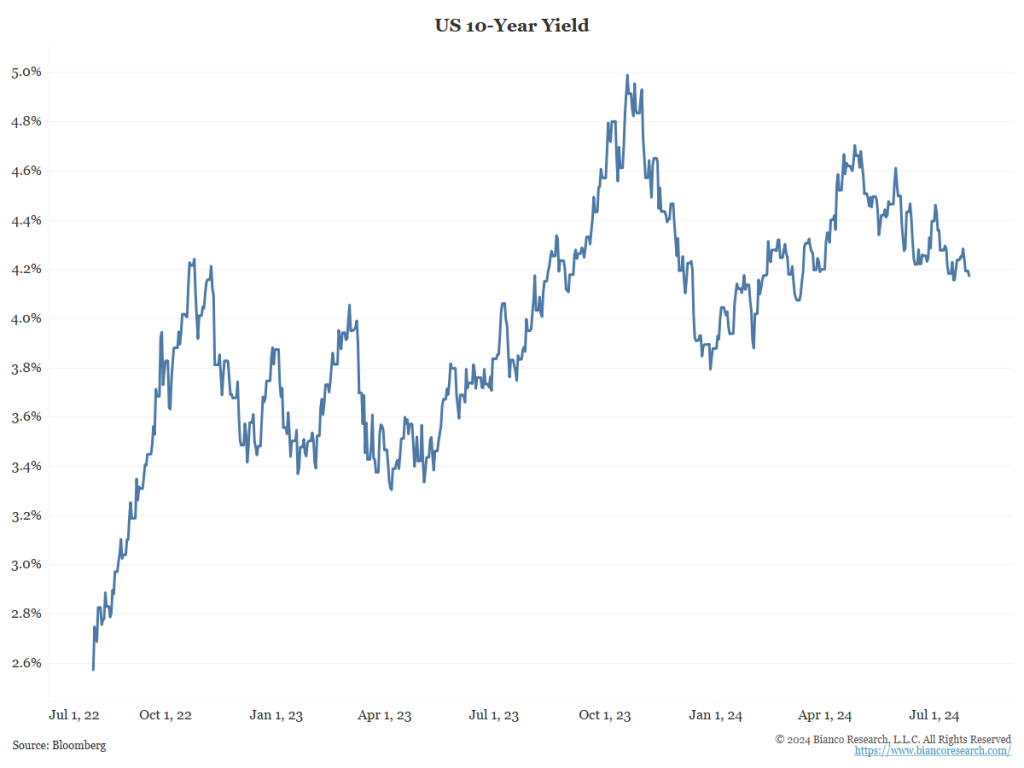

Starting on August 1, the index holds a 90% underweight duration position. The committee expects the economy and inflation to continue to stay strong that expectations resulting in higher yields over the next several months.

No Yield Curve Position

The Index holds no deliberate curve position relative to the benchmark.

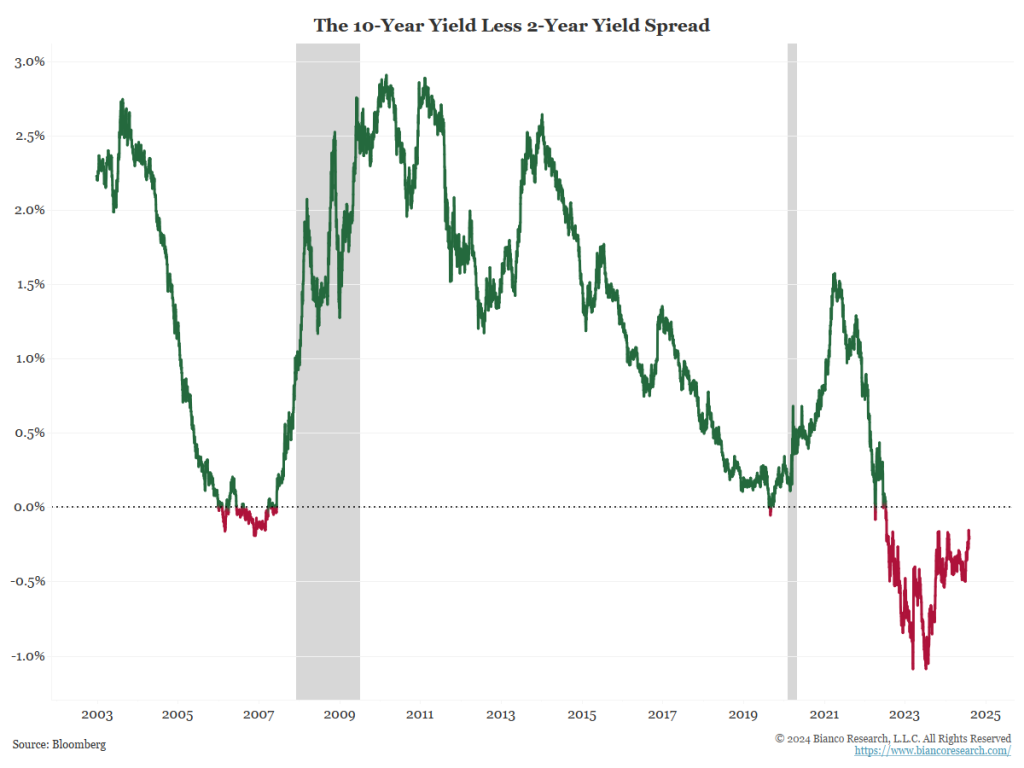

Even though the committee expects the yield curve to steepen, given the currently inverted curve and the expectations for small yield curve changes, less than 50 basis points, yield curve positioning does not matter now.

Hence, our neutral outlook.

90% Underweight Credit

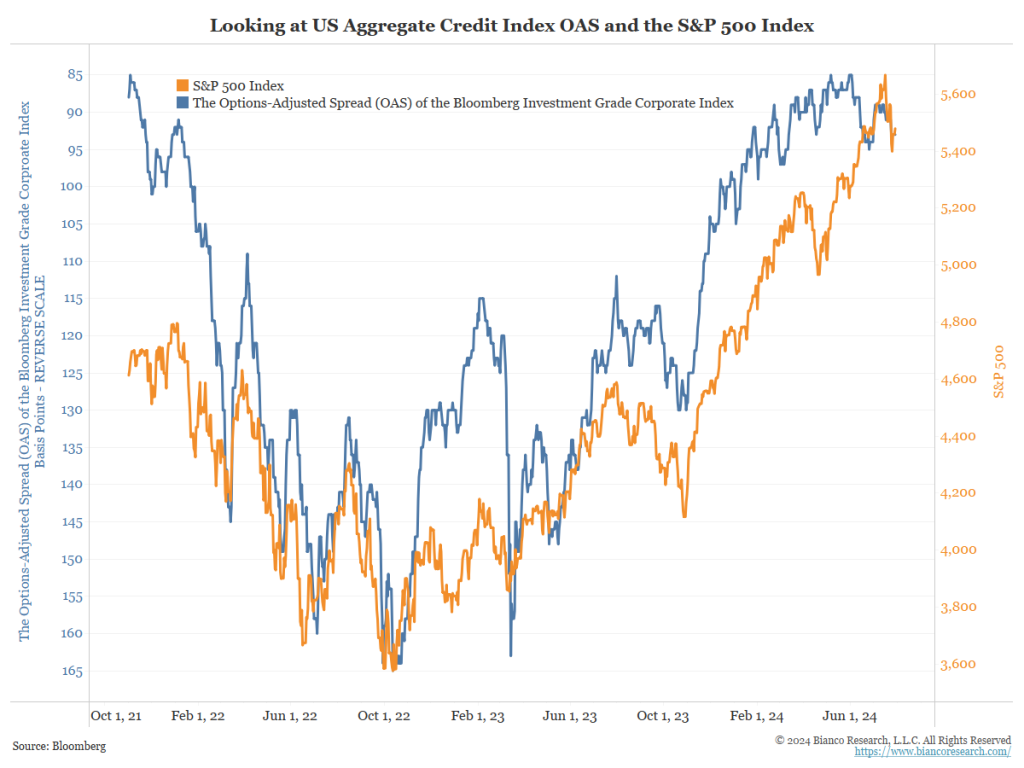

In January, the Index took an underweight position in corporate bonds relative to our benchmark due to record corporate bond issuance and an overbought equity market.

Given similar conditions, the Index will maintain this position.

Neutral Allocation With 50% Allocation to Current Coupon MBS

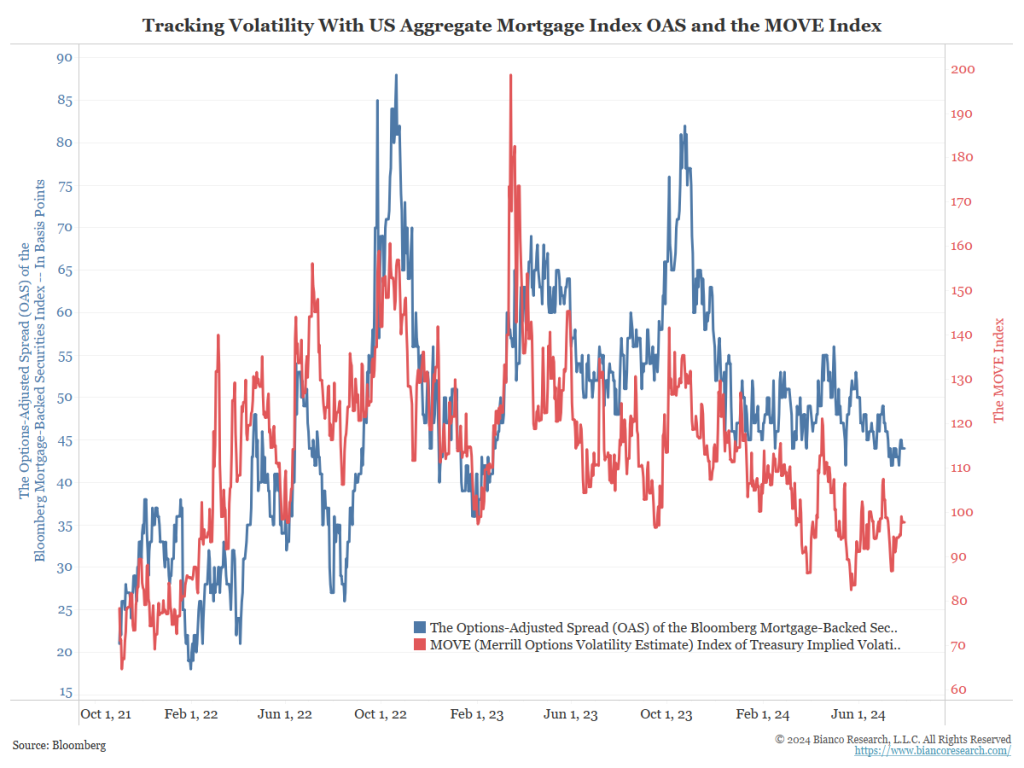

Previously, the Index increased its allocation to MBS from 90% to neutral. The index holds a neutral allocation to MBS. In addition, the securitized sector of the Index now holds a 50% position in current coupon to-be-annouced MBS issues.

Falling volatility (in red, the MOVE Index) helps securitized assets perform better.

5% USD Bullish Conviction Allocation & 5% 0-5 US TIPS

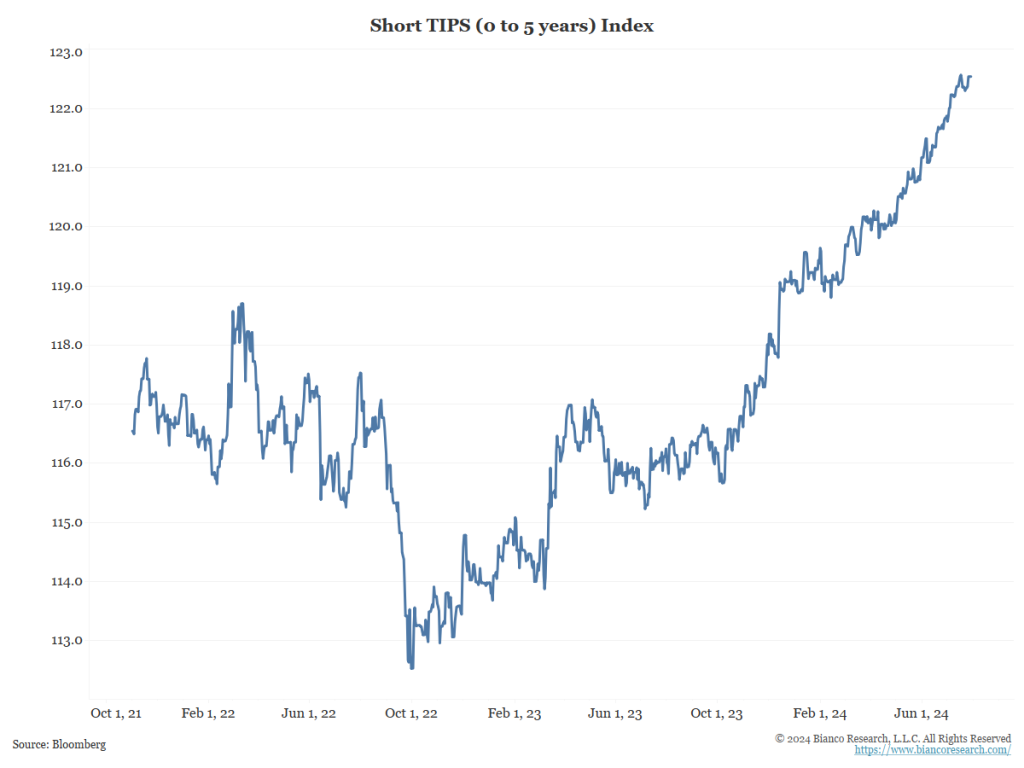

The index previously held a 5% conviction position in bullish USD. This month, the index is adding a 0-5 US TIPS conviction position in addition to the 5% allocation to USD.

The bullish USD bet would benefit if the U.S. economy outperforms the rest of the world, leading to higher yields and a strong dollar.

The short TIPS position will benefit from higher-than-expected inflation readings.

Allocation Changes

| Name | August 2024 | July 2024 |

|---|---|---|

| iShares MBS ETF | 14.00 | 28.20 |

| Simplify MBS ETF | 13.90 | 0.00 |

| iShares 3-7 Year Treasury Bond ETF | 11.90 | 16.90 |

| Schwab Short-Term U.S. Treasury ETF | 10.75 | 9.40 |

| Vanguard Short-Term Corporate Bond ETF | 9.20 | 8.39 |

| Schwab Long-Term U.S. Treasury ETF | 8.50 | 8.85 |

| Vanguard Long-Term Corporate Bond ETF | 6.75 | 7.30 |

| Vanguard Intermediate-Term Corporate Bond ETF | 5.70 | 6.10 |

| iShares 0-5 Year TIPS Bond ETF | 5.00 | 0.00 |

| WisdomTree BBG USD Bullish Fund | 5.00 | 5.00 |

| iShares BBB Rated Corporate Bond ETF | 5.00 | 5.00 |

| iShares 7-10 Year Treasury Bond ETF | 4.30 | 4.86 |