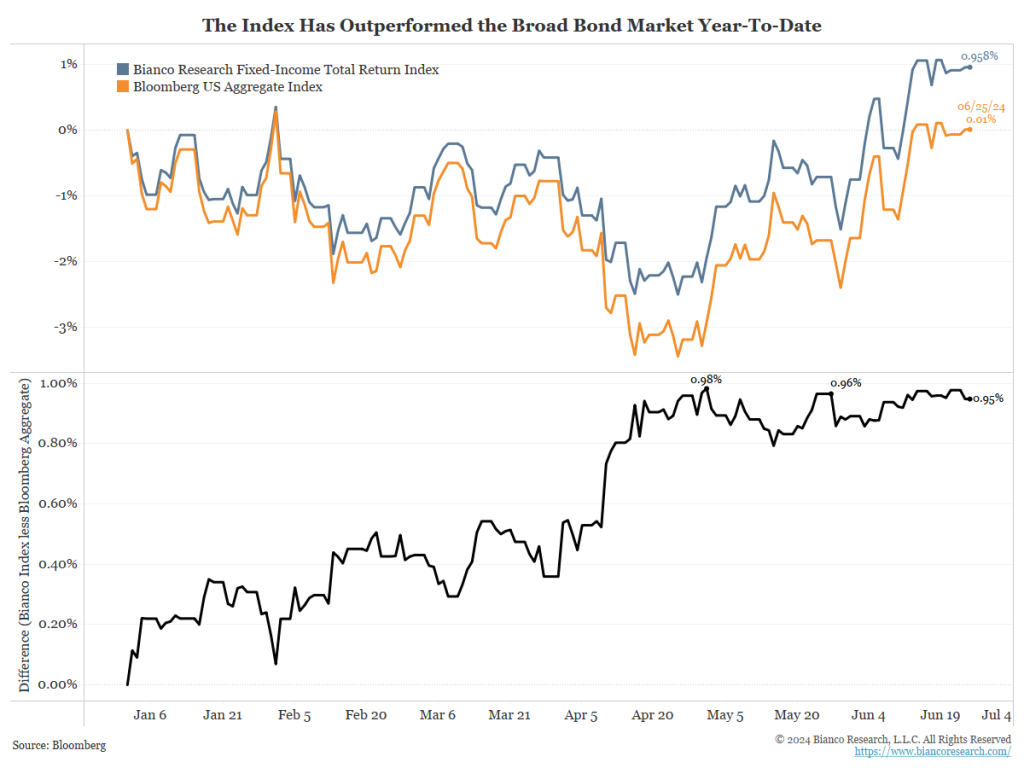

The Bianco Research Fixed-Income Index has outperformed a broad-based benchmark by 95 basis points year-to-date.

While the broad-based index is essentially flat on the year, the Bianco Research Fixed-Income Index is up roughly 0.96%. We believe observable rates will continue to push these total returns higher, and our goal is to continue separating our performance from the overall market.

Relative Positioning

Duration

Neutral Duration

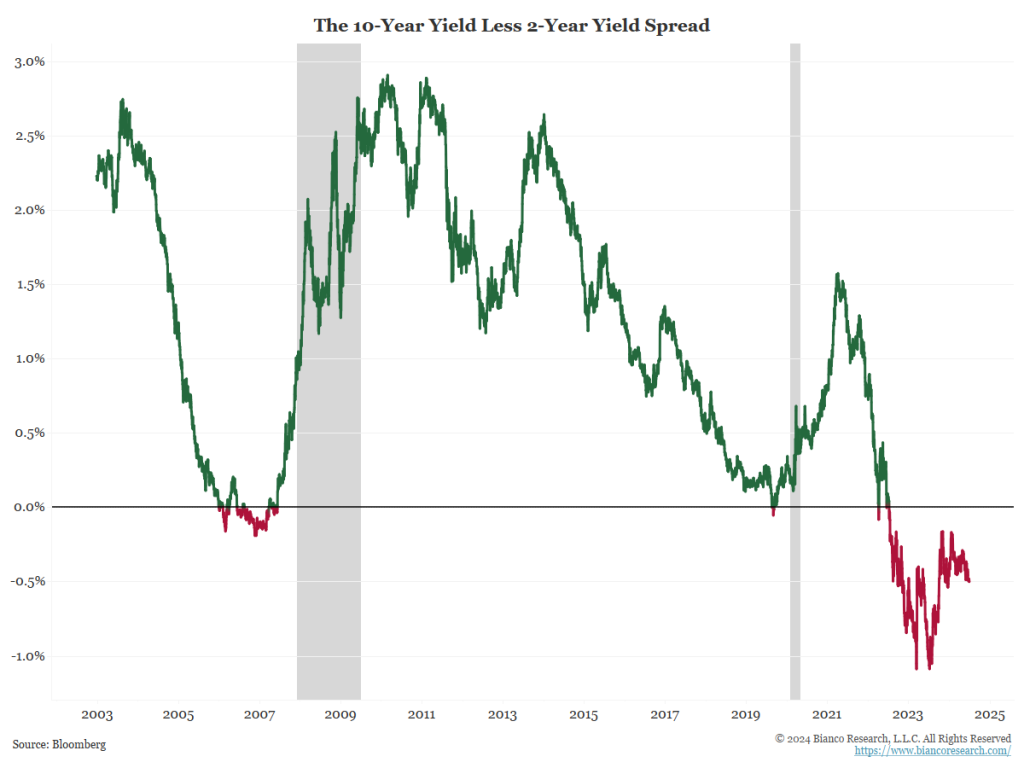

Yield Curve

Neutral

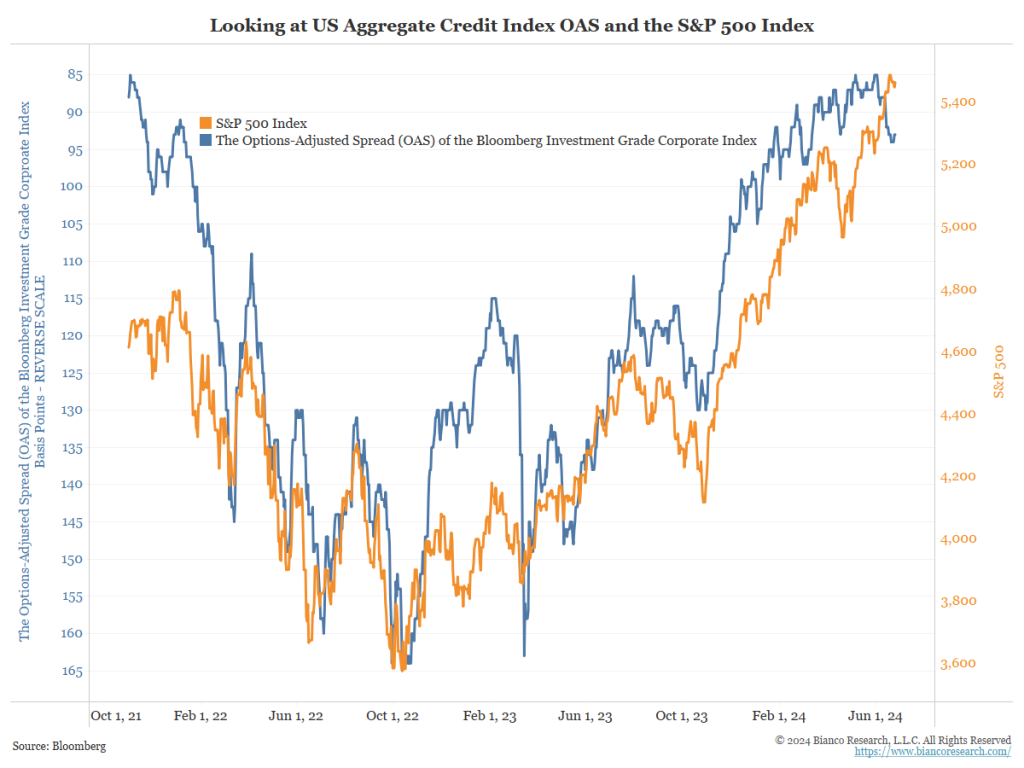

Corporate Credit

Underweight

Securitized

Neutral MBS

Conviction

5% USD Bullish

Our strategy is based on qualitative and quantitative inputs including economic data and interpretations of government policy. Position guardrails include 50% – 200% allocation relative to the benchmark for credit, duration, and structure/mortgage weight. A high-conviction exposure to more speculative or diversifying positions is constrained to 0% – 20%.

The characteristics below reflect how we would best position a portfolio of fixed-income ETFs to achieve maximum total return over a comparable baseline neutral portfolio of fixed-income securities (benchmark).

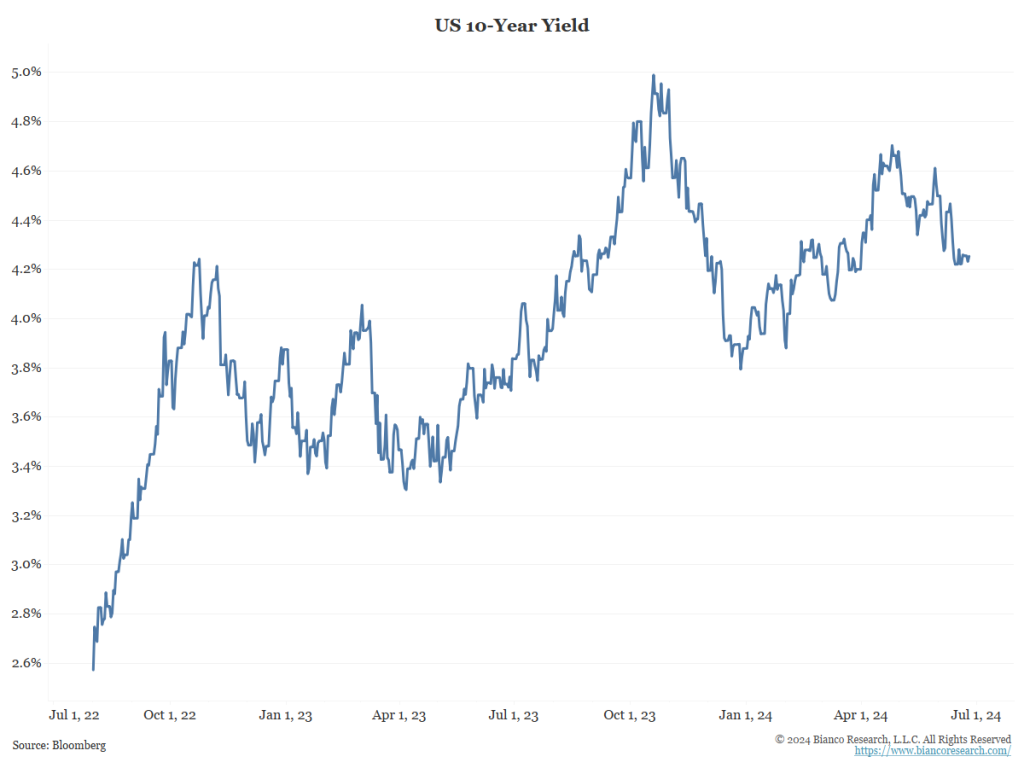

Neutral Duration

At the end of April, the Index moved from an underweight duration position to neutral. The Index remains duration neutral.

We expected the 10-year yield to move to a range of 5.00% to 5.50%. Since most of that move was complete, we did not want to try to pick the exact top in yields.

90% Underweight Credit

In January, the Index took an underweight position in corporate bonds relative to our benchmark due to record corporate bond issuance and an overbought equity market.

Given similar conditions, the Index will maintain this position.

Neutral Securitized

At the end of April, the Index increased its allocation to MBS from 80% to 90%. Following a similar path, the Index moved to a neutral position on MBS at the end of May.

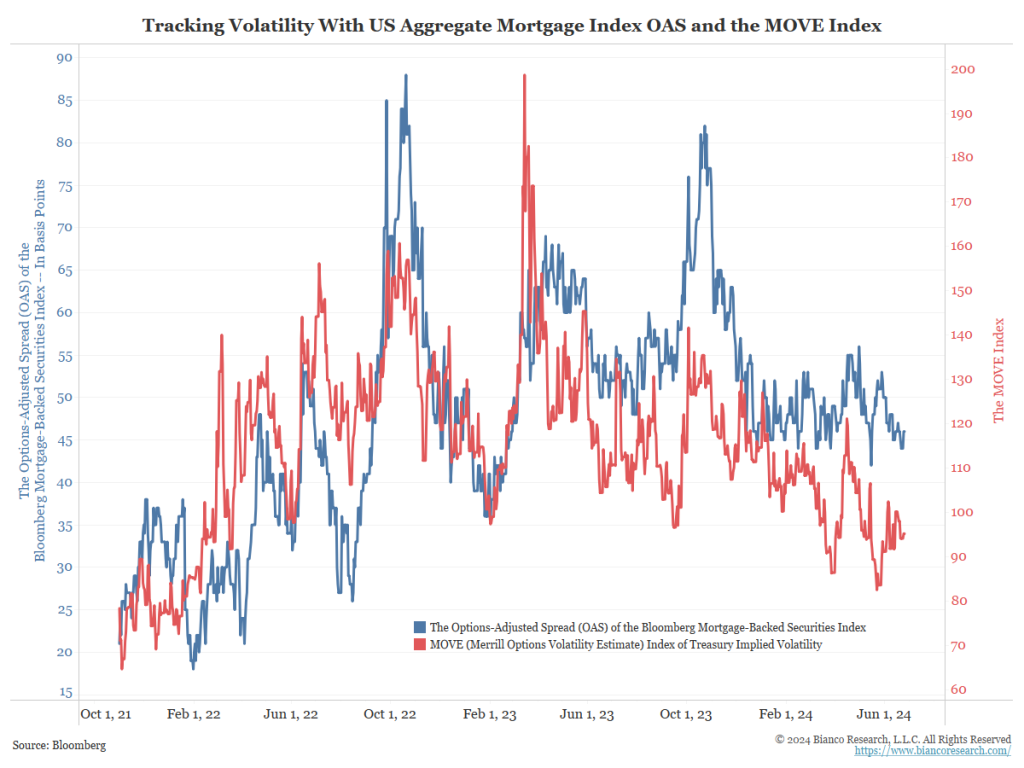

Falling volatility (in red, the MOVE Index) helps securitized assets perform better. Volatility is falling because many of the Federal Reserve’s expected rate cuts disappeared. Given this, the bond market uncertainty index should fall.

However, as discussed above, if the economy stays strong and inflation surprises, uncertainty is expected to return to the bond market, making more than one rate cut difficult.

5% USD Bullish Conviction Allocation

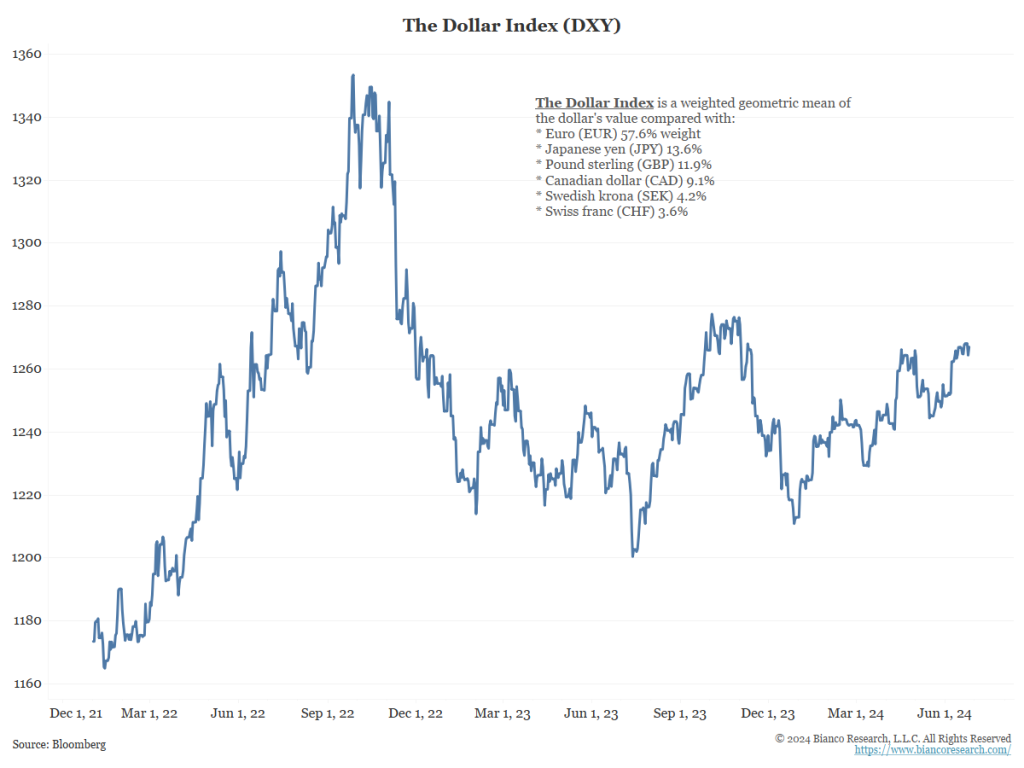

Earlier this year, the Index added a 10% long U.S. dollar conviction position. This bet would benefit if the U.S. economy outperforms the rest of the world, leading to higher yields and a strong dollar.

At the end of April, the Index held a 10% conviction USD bullish position. At the end of May, the Index reduced this holding to 5% from 10% due to increased volatility surrounding the dollar.

Allocation Changes

| Name | July 2024 | June 2024 |

|---|---|---|

| iShares MBS ETF | 28.20 | 28.20 |

| iShares 3-7 Year Treasury Bond ETF | 16.90 | 17.00 |

| Schwab Short-Term U.S. Treasury ETF | 9.40 | 9.65 |

| Schwab Long-Term U.S. Treasury ETF | 8.85 | 8.50 |

| Vanguard Short-Term Corporate Bond ETF | 8.39 | 8.39 |

| Vanguard Long-Term Corporate Bond ETF | 7.30 | 7.30 |

| Vanguard Intermediate-Term Corporate Bond ETF | 6.10 | 6.10 |

| WisdomTree BBG USD Bullish Fund | 5.00 | 5.00 |

| iShares BBB Rated Corporate Bond ETF | 5.00 | 5.00 |

| iShares 7-10 Year Treasury Bond ETF | 4.86 | 4.86 |